Chapter 13 Bankruptcy Involves Which of the Following

Which type of bankruptcy is sometimes called straight bankruptcy and involves the liquidation of all the non-exempt assets an individual owns to immediately pay off debt to creditors. Straight bankruptcy is often called liquidation.

What Is Chapter 13 Bankruptcy How Does It Work

Greenwood Motels has filed a petition for bankruptcy but hopes to continue its operations both during and after the bankruptcy process.

. A- Chapter 13 B- Chapter 11 C- Chapter 7 D- Chapter 9 This is an APEX question. But once the court aspect of bankruptcy is complete youll make payments toward your debts for the following three to. You get to keep all your assets.

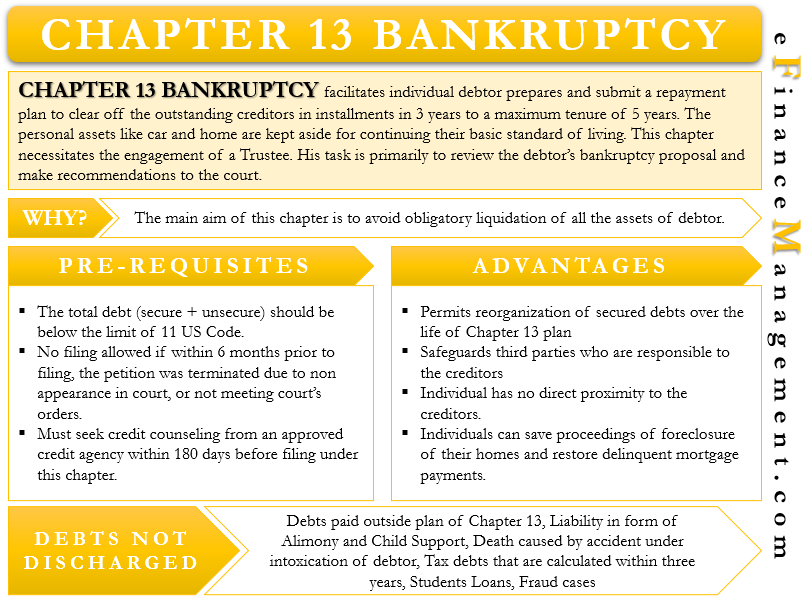

Chapter 13 bankruptcy involves a reorganization of the enterprise. The Chapter 13 payment plan lasts three or five years depending on your income. Debtor must have an already established steady.

Ownership of property that debtor wishes to keep that would be sold in chapter 7. Chapter 13 repayment plans are usually simpler and less expensive than Chapter 11 plans. Second mortgages where the amount owed on the first mortgage exceeds the value of the property.

According to Chapter 13 of the Bankruptcy Code which of the following statements is correct. The debtor makes payments on time and lulls the creditor into shipping more and more goods. You get another chance to incur debt.

Chapter 13 is common for those individuals whose income exceeds the. A typical Chapter 7 bankruptcy case takes three to four months to complete. Chapter 13 bankruptcy or reorganization bankruptcy involves the renegotiation of debt payments in order for the debts to be paid over time.

In a bankruptcy which of the following statements is truea. At the end most of your unsecured debt balances will. An order for relief results only from a voluntary petitionb.

Chapter 13 of the bankruptcy code refers to the US bankruptcy proceedings whereby the debtors undertake reorganization of their finances under supervision and the approval of courts. The debtor then begins missing payments and tells the creditor it is having cash flow problems. Chapter 13 - Leverage and Capital Structure 13.

Accounting insolvency E. Your bankruptcy is recorded on your credit report for twelve years. Chapter 13 permits individuals with regular income to pay their debts to creditors in installment plans under the supervision of the court.

According to Chapter 13 of the Bankruptcy Code which of the following statements is CORRECT. This is another benefit of filing Chapter 13 bankruptcy vs. Whereas chapter 7 bankruptcy involves the liquidation of assets to pay creditors chapter 13 does not involve the sale of assets to the same degree as chapter 7.

1 certifies if applicable that all domestic support obligations that came due prior to making such certification have been paid. Chapter 13 also has a special provision that protects third parties who are liable with the debtor on âconsumer debtsâ This provision may protect co-signers. In an effort to understand how group dynamics change under duress a research team gathers 100 people at a remote mountain location bringing them all in by helicopter.

Debtor should be able to pay entire amount they owe to each creditor. You get a fresh start on your finances. In bankruptcy terms Chapter 7 is often called liquidation.

The bankruptcy trustee and all creditors review the Chapter 13 plan and if itâs acceptable to all involved the court confirms your repayment plan which lasts three to five years. Solutions for Chapter 13 Problem 2P. A chapter 13 debtor is entitled to a discharge upon completion of all payments under the chapter 13 plan so long as the debtor.

Any debtor who files under Chapter 13 could also have filed under Chapter 11. Debtor should be able to pay entire amount they owe to each creditor d. The bankruptcy plan does not require the approval of the unsecured creditors.

A chapter 7 bankruptcy involves which of the following. Presence of a mortgage default on a home the debtor wishes to keep. A rule of thumb for paying more than the minimum payment is minimum payment interest charged additional 2 percent of total balance monthly payment.

In Chapter 13 bankruptcy you repay your creditors some in full some in part through a Chapter 13 repayment plan. There are times where people simply make too much money to avoid a Chapter 13 payment plan or they have a specific reason for filing for Chapter 13 bankruptcy. Most people file Chapter 13 bankruptcy instead of Chapter 7 for two reasons.

The Bankruptcy Act was set up in order to provide assistance to both debtors and creditors. Chapter 7 Chapter 9 and Chapter 11 are the most common forms of bankruptcy. A fraudulent scheme in bankruptcy involves a protracted plan to con a creditor into thinking it is dealing with an upstanding debtor.

Creditors entering an involuntary petition must have debts totaling at least 20000c. The biggest difference between Chapter 7 and 13 is that Chapter 13 bankruptcy involves a payment plan instead of the potential forced sale of assets. Consolidating debt allows you to secure a loan paying off all your debt at a higher rate.

Chapter 7 bankruptcy B. Secured notes payable are considered liabilities with priority on a statement of affairsd. Debt-to-income ration includes daily living expenses.

The debtor can begin making payments to creditors within 30 days of the approval of the plan. Involuntary filings are permitted. Which one of the following terms best applies to this situation.

Finally chapter 13 acts like a consolidation loan under which the individual makes the plan payments to a chapter 13 trustee who then distributes payments to creditors. On the other hand the following weigh towards a chapter 13 bankruptcy. 2 has not received a discharge in a prior case filed within a certain time frame two years for prior chapter 13 cases and four years.

Chapter 7 Chapter 9 and Chapter 11 are the most common forms of bankruptcy. The debtors have to submit and follow through with a plan of repaying outstanding creditors within a period of three to five years. Chapter 7 because the Chapter 7 process can take twice as long.

What Is The Difference Between Chapter 7 And Chapter 13 Bankruptcy Experian

For Consumers Who Face Mounting Debts Bankruptcy Can Seem Like A Viable Option Although A Bankruptcy Declaration Ca Credit Rating Personal Affairs Bankruptcy

Eyes May Deceive Especially When They Involve A View Through The Heart Top Quotes Eyes Quotes

13 Best Money Making Apps That Payout Fast 2021 Best Money Making Apps Money Apps Small Business Blog

Chapter 13 Bankruptcy Attorney In Ohio Amourgis Associates

Bankruptcy Basics The Ultimate Bankruptcy Law Introduction Talkov Law

Insolvency Can Hurt Small Business Loan Application Small Business Loans Business Loans Small Business

Chapter 13 Bankruptcy Understanding The Basics Lendingtree

Will Bankruptcy Discharge A California Judgment California Map Map California

Chapter 13 Bankruptcy After Chapter 7 Bankruptcy

How Does Bankruptcy Work And Is It Right For Me Debt Free Debt Debt Repayment

Triangular Arbitrage Meaning Example Risks And More Business And Economics Accounting And Finance Currency Market

How To Get A Gubernatorial Pardon In The State Of California Fresno Criminal Defense Lawyers Crimi Criminal Defense Lawyer Criminal Defense California State

Tips For Hiring A Chapter 13 Bankruptcy Lawyer Posts By Medialiu Family Law Attorney Attorney At Law Law Firm

Bankruptcy Cost It Could Cost You Much More Than You Expect Finance Investing Accounting And Finance Money Management Advice

Chapter 13 Bankruptcy Define Why To File Eligibility Advantages Efm

Bankruptcy Chapter 13 Worksheet And Personal Bankruptcy Worksheet Monthly Budget Worksheet Budgeting Worksheets Consumer Debt

Comments

Post a Comment